Legacy identity verification solutions expose your organization to risk

Legacy identity verification and CIP/KYC solutions are incorrectly returning matches ~5% of the time while also being unable to verify certain segments of the population across different ages, races, and socioeconomic classes over 10% of the time.

Socure Verify leads the industry with unparalleled coverage

99% verification of mainstream populations

95% verification of Gen Z consumers

40% reduction in manual reviews

Key Benefits

Assurance of consumer identity

Securely onboard customers while reducing friction and identity risk

Automate customer onboarding

Enhance operational efficiency while minimizing errors

Exceed CIP/KYC requirements

Make confident, explainable decisions for easy compliance

Harness hundreds of data sources and patented technology for unsurpassed identity assurance

Our triangulated data approach leverages artificial intelligence and machine learning to verify an identity across 400+ trusted sources, and then correlates thousands of identity data points—online and offline—to resolve to a single best-matched entity.

360-degree view of identity

- Multidimensional view of any consumer through hundreds of traditional and trustworthy alternative authoritative data sources including:

- Credit bureau

- Alternative credit

- Telco

- Consumer banking and payment

- Student information

- Other NIST 800-63 authoritative sources

- Proprietary cross-industry feedback data of billions of known transaction outcomes

- Unmatched coverage of hard-to-verify populations including Gen Z and new-to-country

- Persistent identifier prevents duplicate records and identity manipulation plus insights into behaviors and transaction history

Precise and accurate identity verification

- Proprietary machine learning transcends the limitations of rules-based logic for automated decisioning that minimizes false positives/negatives

- Intelligent risk assessment from contextual information such as addresses, transaction history, and relationship networks

- Minimize impact in ethnic, racial, age, and socioeconomic bias present in legacy identity verification solutions

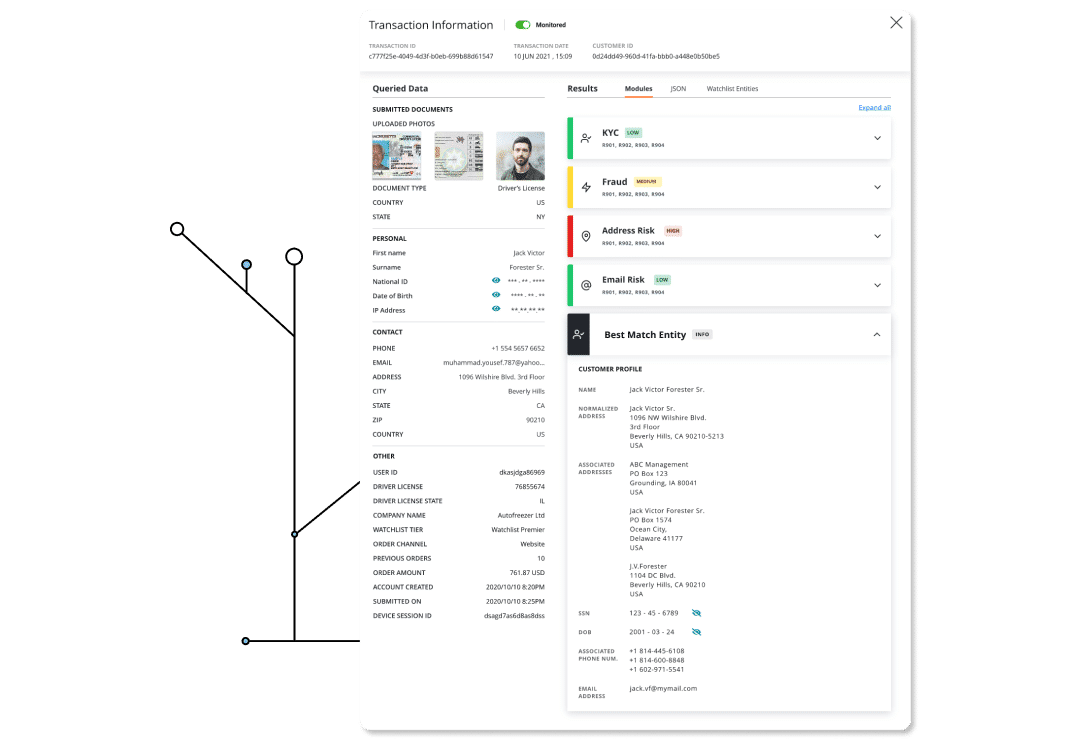

Rich customer metadata

- First, middle, last name, and any suffixes

- Current mailing address normalized per USPS mailing standards

- Full 9-digit SSN with issuance date

- Date of birth

- Deceased date (if applicable)

- Current and associated phone numbers

- Current and associated email addresses

- First and last seen dates

Actionable insights in an intuitive dashboard

- Confident operations with full transparency of the best-matched entity

- Streamlined manual reviews with side-by-side comparison of consumer input data with best matched entity

- Rapid risk layer extraction with detailed reason codes, field validation scores, and first-seen dates

Key Capabilities

Optimized search queries to return more matches

Optimized search query logic returns the largest possible pool of identity matches

No exact character match required

Billions of records searched in under a second to find matching identities

Precise results with the single best-matched entity

Matched entities are ranked by significance and returned with the single best-matched entity

Actionable intelligence through detailed reason codes

Precisely extract the risk layer from reason codes with field validation scores for informed decisions

Algorithmic name matching

Precise identification for similarities in various name permutations, nicknames, misspellings, and more

Robust date of birth matching

Resolve an input date of birth to eight different accepted formats and combinations

Advanced SSN matching

Overcome common errors such as typos and miskeys, and verify results from diverse data sources

Best-in-class address normalization

Receive the current mailing address, with up to 3 recent associated addresses with >99.5% coverage surpassing industry standards

Scale high-volume transactions while substantially reducing manual processes with Socure Verify+

Available API response of matched customer data with full risk and reason codes to automate exception processing, ensure accurate customer data, bolster compliance, and more.

Automate dispositioning

Automatically parse and approve, e.g. PII returned is within a particular tolerance threshold, or reprompt consumers to update applicable PII

Maintain accurate customer records

Ensure good data hygiene through normalized data to eliminate common keystrokes and data capture errors

Enhance compliance

Adhere to SEC 17AD-17 and FACTA Red Flag requirements

Create custom approve/deny lists

Maintain an organization specific list of repeated good or bad actors for automated decisioning

Datos Insights 2023 AML Impact Award Winner

Best Know Your Customer/Business Innovation

Recognized for innovation in accurate, inclusive identity verification of hard-to-identify populations including Gen Z, new-to-country, credit-invisible and thin-file.

Resources

eBook

Legacy IDV Vendors are Exposing You to Risk

Learn how to protect your business and stay ahead of the curve.

Read MoreWhite Paper

Digital Identity Fairness & Inclusion Report

Read Socure’s detailed research findings—including comparisons across different systems and approaches.

Read MoreFact Sheet

Socure Verify

Learn how Socure Verify automates the customer onboarding process with unrivaled data coverage and industry-leading technology.

Read More