Power Conversions, Growth & Revenue

Accept More Shoppers

Auto-Approve More Consumers

Attract More Merchants

Grow Your Customer Base

Protect Your Customers

Eliminate Fraud Losses

Upgrade to Socure & Unlock Instant Results

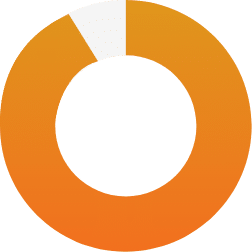

Auto-accept up to

97%

Capture up to

90%

Join Socure’s Network of Leading BNPL Providers and Alternative Payment Customers

4

of the top 5 banks

12

of the top 15 credit

card issuers

250+

top BNPL providers and fintechs

3

of the top MSBs

Trusted by Leading Companies

How It Works

Establishing Trust Throughout the Customer Lifecycle

Verify shopper identity at account opening

Authenticate shopper identity at point of transaction

Check identity elements during shopper account updates

Purpose Built for BNPL Providers

New Accounts

Auto-Accept More Shoppers

Transactions

Stop Fraud, Increase Approvals

Know Your Customer

Meet Compliance Mandates

TCO

Reduce Operational Costs